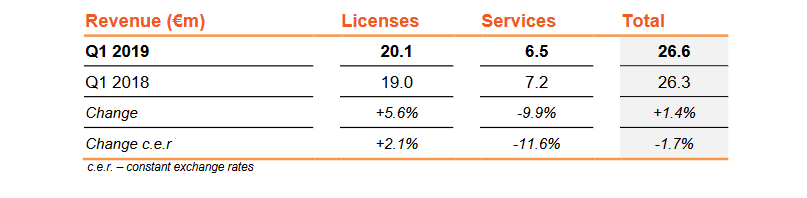

Q1 2019 revenue up 1.4% to €26.6 million

- Growth in license sales

- Solid installed base

- Continued rollout of focused sales plan

ESI Group, Paris, France, (ISIN Code: FR0004110310, Symbol: ESI) announced today its revenue for the first three months of the 2019 financial year.[1]

Cristel de Rouvray, Chief Executive Officer of ESI Group, commented: “Our business model does not lend itself to quarterly interpretation, as quarterly metrics do not give a true picture of the results we expect from our focused sales plan. Looked at from a mid to longer term perspective, the solidity of our installed base is demonstrated by a very high recurrence. The trust of our innovation partners will help us to compensate for a slow start in the Services business. In this early part of the fiscal year, we continue to confidently and rigorously roll out our plan to create sustainable and lasting value for all our shareholders.”

Licensing, the mainstay of the ESI Group’s business model, accounted for 76% of total revenue this quarter. License sales in the first three months of the fiscal year1 were up 5.6% to €20.1 million. The dynamic performance of our installed base (representing 79% of the Licenses business) was driven by renewals and additional volume, with a repeat business rate of 89.4%. Note that perpetual licenses sales decreased by €1 million vs. the same period last year, another indicator of long-term sustainability and the increasing efficacy of our strategy to focus on annual rental licenses with high renewal rate.

Services, representing 24% of total revenue, include studies for industry, advanced application research and R&D and also training. Revenue for this business line came out at €6.5 million (down 9.9% year to year). This does not reflect the number of important projects confirmed in the period These include the multi-year agreement signed with EDF for high value-added engineering studies related to design and maintenance of nuclear power plants a 6 year contract with the option to extend for a further 4 years.

In a geographical mix where Europe and Asia represent 82% (43% and 39%, respectively) of quarterly sales, revenue in the Americas region picked up amplified by a currency effect, and driven by license sales, especially in the aeronautical industry.

[1] Exceptionally, 11-month financial year ending on 31/12/2019, subject to the approval of the AGM meeting on 18 July 2019; Q1 reported here covers February, March and April of our traditional 12 months fiscal year